How business can meet the challenge of climate change

Companies that look ahead and turn detailed risk assessments of climate change into innovation will be much better equipped to meet the new world that awaits us.

Who will be the economic winners and losers of climate change?

And more specifically how can businesses adapt?

Climate change is obviously an unwanted and negative risk to all societies. Former President Barack Obama elegantly summed up the situation in 2014 when he said “we are the first generation to feel the effect of climate change - and the last generation who can do something about it”.

This global urgency is also reflected in one of the UN’s Sustainable Development Goals: “take urgent action to combat climate change and its impacts.”

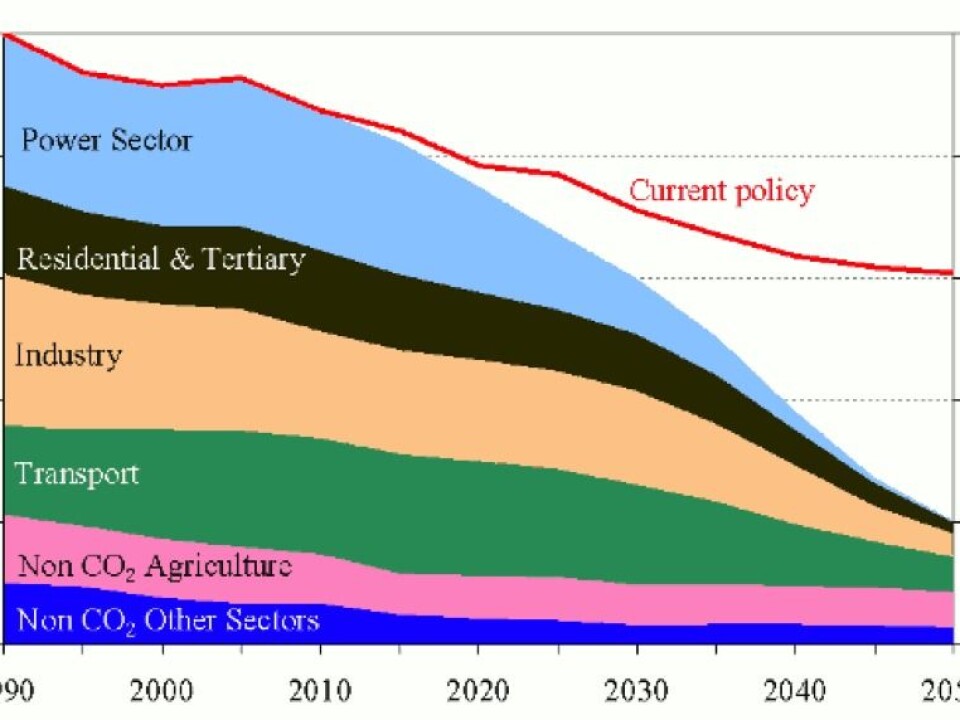

The success and failure of companies in the near future will be determined by how the private sector adapts to, and reduces, risks associated with climate change. But what does this mean for industry facing demands for drastic CO2 emission reductions?

Read More: Is the UN too slow to tackle climate change?

Little research on the private sector

The Paris Agreement from Dec 2015 confirmed the global commitment both to reducing greenhouse gas emissions as well as adapting to the changing climate by strengthening the societal ability to deal with the associated impacts, vulnerabilities, and risks as well as reducing damages and losses.

The European Union is already taking action and has developed an adaptation strategy, which was implemented in 2013. This plan will be revised this year, and a new strategy will be presented in 2018. The new strategy is expected to pay even more attention to the private sector and adaptation at the local level.

Until recently, the majority of research has been directed towards describing how the public sector is adapting and little scientific attention has been granted to understanding the challenges facing the private business sector, including 26 million active private enterprises in Europe with some 143 million employees and its value-chains.

How the private sector adapts to increased climate risks and while meeting demands for both drastic CO2 emission reductions in accordance to the EU2050 Road-Map and also reducing their climate risks, is still an open question.

Read More: How to nudge consumers to make greener choices

Supply chains need to be protected

One example of how climate change will impact international companies is by disrupting their supply chains.

The flooding in Thailand in 2011 is a good example. It was the worst flooding in 70 years and came as a result of heavy rainfall and tropical storms. When the floods hit the poorly drained, built up industrial parks that housed 804 companies, they immediately disrupted the global supply of electronic and car components.

It took two months to completely discharge the floodwater from the inundated industrial complexes, causing supply chain and production interruptions for big global computer brands like Acer, Samsung, Lenovo, and Apple, as well as for car manufacturers like Toyota and Honda.

The corporate economic damage of the flooding was estimated at nearly 44 billion USD. Surveys show that most of the affected companies want to continue to operate in these locations, but that costs may increase when manufactures ask their suppliers to diversify risks and procurement sources to offset the risk associated with doing business in locations known to be vulnerable to such climate-related risks.

Read More: Glaciers are vital for Greenland’s fisheries

Access to climate data and early warning systems are vital

Estimations for Europe show that access to climate and hydro-meteorological information, and early warning systems save several hundreds of lives per year, and can avoid between $596 million and $3.5 billion of disaster asset losses per year.

In 2016, a seminal article in Nature Climate Change found that the total global value of assets vulnerable to climate-related risks are estimated to be between 2.5 and 24.2 trillion $US, depending upon the type of future climate and socioeconomic development scenarios.

Of course, investors are increasingly aware of these risks and are starting to change their investment portfolios accordingly. But the climate risks need to be better disclosed to the markets for this to happen. And to do this, they need more research to develop comprehensive estimates of the risk of the losses at the company level.

Read More: A smarter power grid with new materials

Investment risk depends on climate

The recommendations of the G20 Task Force on Climate-related Disclosures could boost the disclosure of climate action by the private sector. In 2015, the investment company Mercer developed a process to assess investment risks related to climate called TRIP, which stands for:

- Technology (T) is broadly defined as the rate of progress and investment in the development of technology to support the low-carbon economy.

- Resource Availability (R) refers to the impact on investments of chronic weather patterns (for example, long-term changes in temperature or precipitation) and related physical changes.

- Impact (I) is the physical impact of acute and extreme weather

- Policy (P), which is broadly defined as all international, national, and sub-national targets, mandates, legislation, and regulations meant to reduce the risk of further climate change.

Some rating agencies, such as Standard and Poors and Moody’s, have already announced plans to assess the climate risks facing both companies and countries and to better inform investor groups about companies’ exposure to climate risks. While the World Economic Forum Global Risk report 2017 describes the failure to mitigate and adapt to climate change as the most significant risk facing society in 2017, including businesses.

Read More: Will your house stand in the next storm?

Companies that look ahead can thrive in a new climate

Another side to this was highlighted by the Global Opportunity Report 2017, which identified cost-efficient adaptation to climate change as one of the top opportunities for business.

Corporate companies that can assess, communicate, and mitigate their CO2 emissions as well as their climate induced risks to meet international investors demands, while protecting their value- and supply-chain, stand to gain market advantages in the light of climate change.

Consultancies will allow companies to do this in a cost-optimal manner, by conducting detailed risk-cost-benefit assessments to inform investments and to optimise the return of these for each company.

Read More: COP21: Are we ready for what climate change has in store?

In fact, there are growing business opportunities for consultancy companies as climate service providers in many different sectors.

For example, we need innovation in resilient materials and services, new weather and climate analytics, climate-resistant seeds, crops, and farming methods. We also need financial and insurance products as an incentive to pursue resilience, water-efficient technologies, flood control and site drainage, along with efficient air conditioning services, back-up power generation systems, insulation against heat, and many other products and services.

Companies that look ahead and who turn detailed climate risk assessments into innovation potentials combined with sound economic assessments and planning will be far better equipped to face the new risks, changing market place conditions, and policies, in a world impacted by climate change.

---------------

Read this article in Danish at Forskerzonen, part of Videnskab.dk