Norwegians have substantial pension capital — so why should the retirement age be increased?

Norwegians currently have about NOK 3 million per person on average in pension capital — but increasing life expectancies have some experts advocating a gradual increase in retirement age.

It wasn’t an easy task, but statisticians at Statistics Norway decided to figure out exactly how much money will be available to the average Norwegian when he or she reaches retirement age.

“It was a painstaking job,” said Elin Halvorsen, head of research at Statistics Norway. She conducted the assessment, “Pension assets in Norway 2017” (in Norwegian) with colleagues Per Ove Smogeli and Dennis Fredriksen. The assessment is the first of its kind in the world.

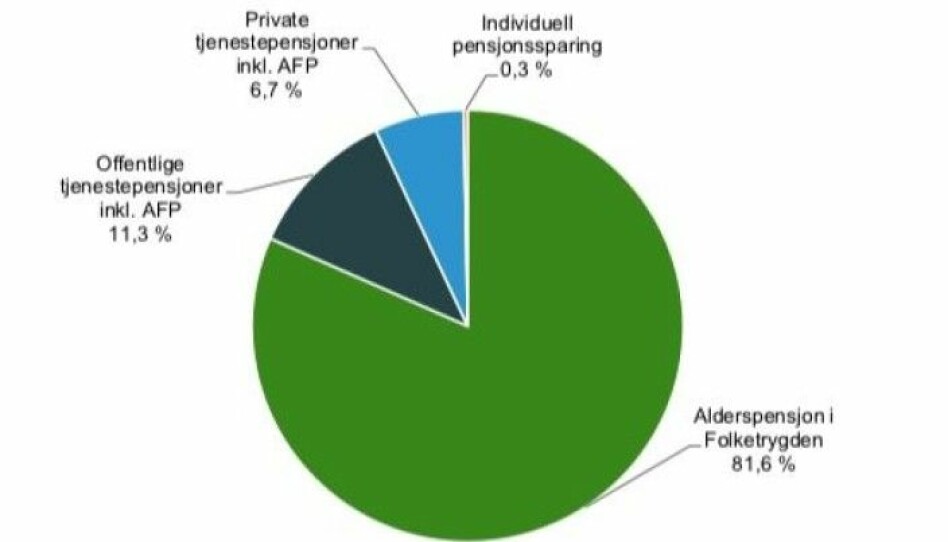

Norway’s pension system is complicated, with a basic pension provided by the state’s National Insurance Scheme. Workers also have an occupational pension on top of this, and individuals can also save into private pension plans.

The researchers were able to collect data on private and public pension entitlements to come up with their 2017 estimate of NOK 2.9 million in pension entitlements per person, on average. For 2019, that total is estimated to be NOK 3 million in today’s krone, or just under EUR 300 000 per person.

The study shows how large — and important — the Norwegian National Insurance Scheme is for all retirees.

Differences in occupational pensions

One thing the study demonstrated was how well the National Insurance Scheme redistributes wealth in Norway, taking money from wealthy people and giving it to those who are of lesser means.

Nevertheless, the study also highlighted the differences in various occupational pensions for Norwegian workers.

“Occupational pensions are far more unequally distributed than the national pension,” says Nils Martin Stølen, a pension researcher at Statistics Norway. “The great inequality between public employees and private employees is something that will continue for the foreseeable future.”

Private employees, particularly people who work in the hotel and restaurant sector, had the lowest levels of occupational pension wealth, with approximately NOK 120 000 per person on average. In contrast, people employed in the petroleum industry had an average of NOK 1.6 million in earned pension capital.

Public sector employees also had a healthy earned pension capital, averaging roughly NOK 1.3 million in earned occupational pensions.

All of these values are in today’s krone.

An ageing population, more retirement years

While this is mostly good news for Norwegians, one pension researcher says the country needs to boost its retirement age as the life expectancy for Norwegians increases.

“This solution means that the proportion of life we spend as pensioners is kept stable, while at the same time we can avoid increasing poverty among pensioners as pension payments continue to be adjusted downwards,” said Axel West Pedersen, a pension researcher at the Institute for Social Research.

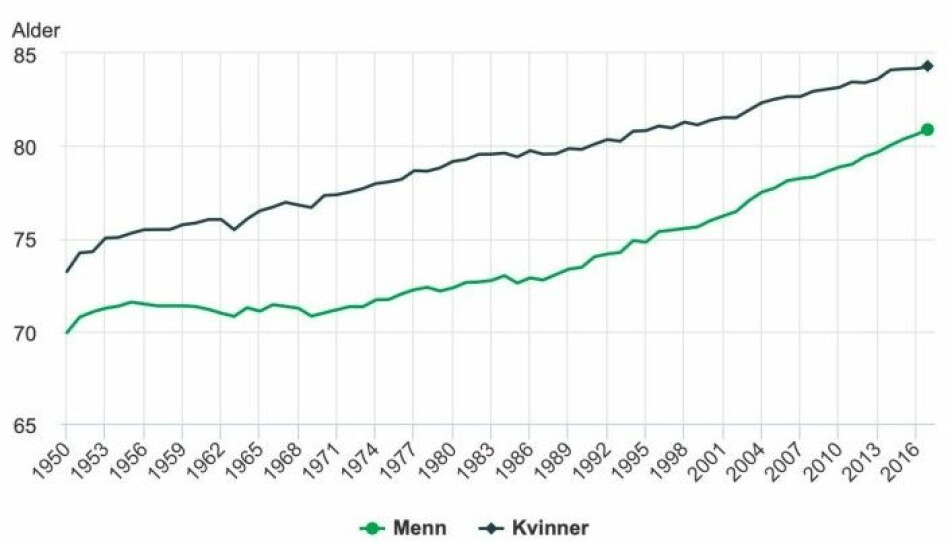

When the National Insurance Scheme was introduced in Norway in 1967, men lived on average until they were just over 70 years old, and women lived a few years longer.

Norwegian men now live on average until they are 81, and Norwegian women live until they are just over 84. That trend will continue, according to population projections from Statistics Norway, which show that today’s 50-year-olds can likely expect to live until they are 90.

Standardized retirement age

Countries around the globe have faced this exact problem, where people live longer but retirement ages don’t reflect that reality. In 2011, Norway undertook a major pension reform that essentially cut the amount of money Norwegian retirees receive year after year, at the same time as their life expectancies increase.

This approach means that if you are a young worker today, you will likely have to work until you are 70 or more to earn enough pension to retire comfortably.

West Pedersen suggests a different approach, under which the retirement age for everyone is increased in step with increasing life expectancies. Denmark, Finland, Italy, the UK, Germany and now Sweden have all adopted this approach.

West Pedersen suggests what he calls a standardized retirement age.

Under this approach, when life expectancies have increased by a year, the standardized retirement age would be increased by 2/3 of a year. If this approach were to begin with retirees born in 1943, someone who was born in 1960 would see their retirement age increased to 69. Someone born in 1970 would have to work until they were 70 to retire with a full pension.

“By increasing the age at which we allow people to draw on their guaranteed pension rather than lowering the amount of the benefit, we can ensure that the minimum benefit in the pension system follows the general trend for wages overall,” West Pedersen said.

———

This article is based on two articles on forskning.no, one on increasing the retirement age, and one on the average pension assets of Norwegians.